Table of Contents

The West’s Efforts to Reduce Dependence

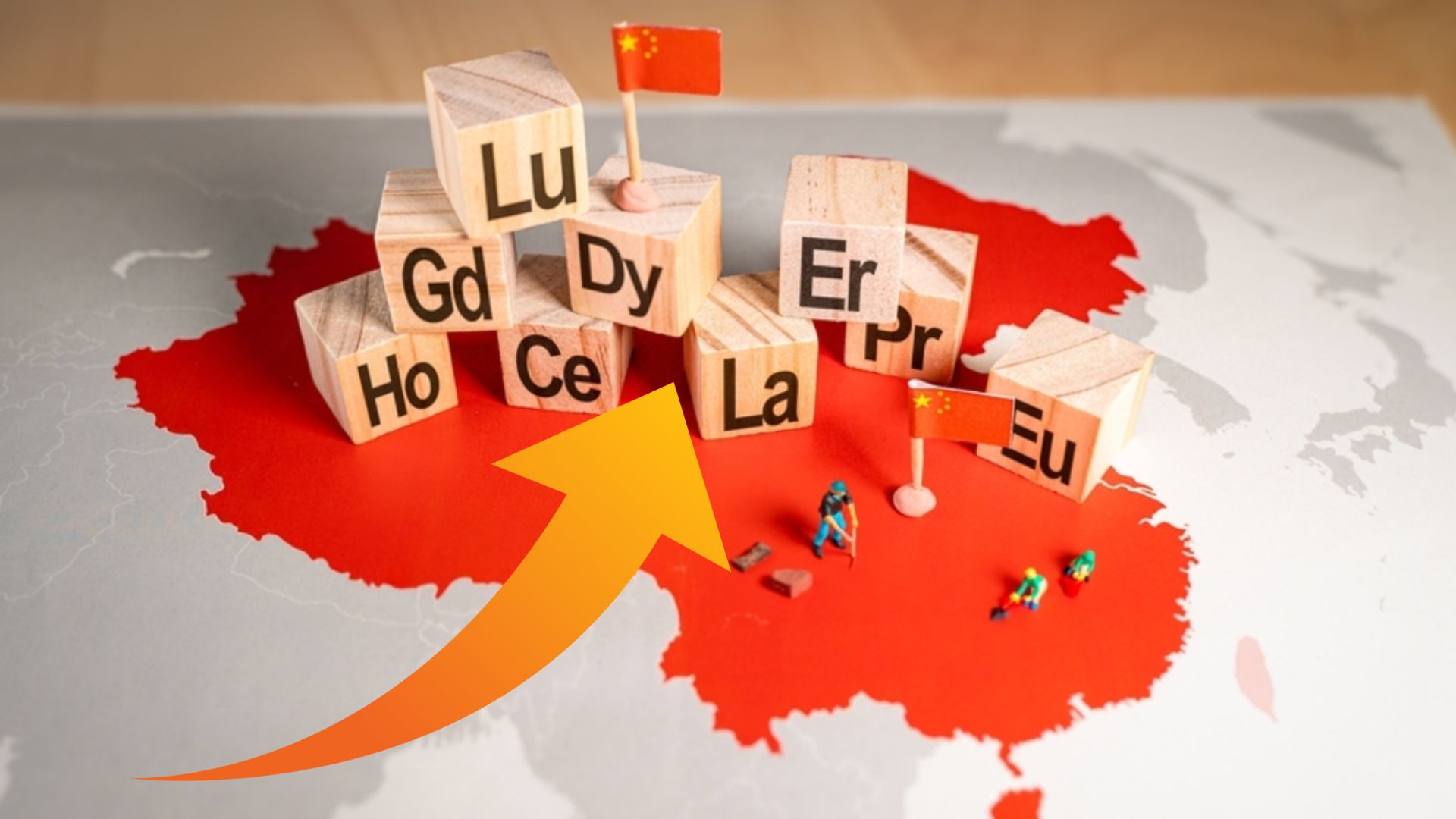

The West is working to reduce its dependence on Chinese rare earth as China tightens its grip on the global supply of key minerals. This includes finding alternative sources of rare earth minerals, developing technologies to reduce reliance, and recovering existing stockpiles through recycling products that are reaching the end of their shelf life. “You cannot build a modern car without rare earths,” said consulting firm AlixPartners, noting how Chinese companies have come to dominate the supply chain for the mineral.

China Rare Earths Supply U.S. and Japanese Actions

A business called Rare Earth Salts, which seeks to extract the oxides from domestic recycled products like fluorescent light bulbs, received $4.2 million from the U.S. Department of Defense in September 2024. Additionally, Toyota, a Japanese company, has been spending money on technology that lessens the usage of rare earth elements.

China’s Market Share and Global Production

According to the U.S. Geological Survey, China controlled 69% of rare earth mine production in 2024, and nearly half of the world’s reserves. Analysts from AlixPartners estimate that a typical single-motor battery electric vehicle includes around 550 grams (1.21 pounds) of components containing rare earths, unlike gasoline-powered cars, which only use 140 grams of rare earths, or about 5 ounces. More than half of the new passenger cars sold in China are battery-only and hybrid-powered cars, unlike the U.S., where they are still mostly gasoline-powered.

The Shifting Landscape of EVs and Rare Earths

According to Christopher Ecclestone, principal and mining strategist at Hallgarten & Company, “the imperative for replacing Chinese-sourced materials in EVs is declining as EV uptake (in the U.S.) slows and mandates to convert from ICE to EV formats recede into the future.” “The first generation of EVs will be able to recycle themselves pretty soon, meaning that the West will have control over a pool of ex-China material,” he stated.

According to Cox Automotive, only 7.5% of new U.S. car sales in the first quarter were electric, a little rise over the same period last year. It said that although manufacturers continue to rely on imports for the parts, almost two-thirds of EVs sold in the United States last year were put together locally. “The market will be further distorted by the ongoing, full-fledged trade war with China, the world’s top supplier of EV battery materials.”

Use of Rare Earths in Vehicles

The 1.7 kilograms (3.74 pounds) of components containing rare earths found in a typical single-motor battery electric car, 550 grams (1.2 pounds) are rare earths. About the same amount, 510 grams, is used in hybrid-powered vehicles using lithium-ion batteries.

China’s Export Controls and Their Impact

China declared export restrictions on seven rare earths at the beginning of April. According to statistics from AlixPartners, one of the limitations was terbium, of which 9 grams are normally used in a single-motor EV. The research shows no considerable use of any of the six other targeted rare earths in automobiles. April’s list isn’t the only one, though. Cerium exports are restricted by a different Chinese list of metal regulations that went into effect in December. According to AlixPartners, a single-motor EV uses an average of 50 grams of cerium.

Moreover, due to the restrictions, Chinese businesses that handle the minerals need permission from the government before they may sell them abroad. Days after a trade truce between the United States and China, Caixin, a Chinese business news agency, announced on May 15 that the commerce ministry had granted export licenses to three prominent Chinese rare earth magnet businesses for shipment to North America and Europe.

The Challenge of Finding Alternatives

What’s concerning international business is that there are barely any alternatives to China for obtaining the rare earths. Mines can take years to get operating approval, while processing plants also take time and expertise to establish.

“Today, China controls over 90% of the global refined supply for the four magnet rare earth elements (Nd, Pr, Dy, Tb), which are used to make permanent magnets for EV motors,” the International Energy Agency said in a statement. That refers to neodymium, praseodymium, dysprosium and terbium.

According to AlixPartners, the amount of rare earths in the less popular nickel metal hydride batteries found in hybrid vehicles can reach 4.45 kilos, or almost 10 pounds. This is mostly due to the fact that that type of battery requires 3.5 kg of lanthanum.

Conclusion

Over the past two years, China has expanded its authority over key minerals, a larger class of metals. China said in the summer of 2023 that it would limit the export of germanium and gallium, two elements used in the production of chips. A year or so later, it declared limitations on antimony, which is a key component in lead-acid batteries, bullets, and the manufacturing of nuclear weapons. Antimony is also used to reinforce other metals.

The nation’s top executive body, the State Council, published a comprehensive policy in October to tighten controls on exports, including minerals, that may have dual-use qualities or be employed for both military and civilian objectives.

Also read – Trump’s EU Tariff Threat: What’s at Stake Ahead of the July 9 Deadline?

Read more about Trending Financial Upadtes at Themarketmint.com

Hey! I am Aastha Khade. I like making complex topics about economy, business, finance and the stock market simple and easy to understand. I am here to write blog posts on trending topics like finance, business and what’s happening in world!

2 thoughts on “China Rare Earths Supply: How the West Is Reducing Dependence?”